Appetite surges for retail credit, but data points to a worrying trend

Source: Appetite surges for retail credit, but data points to a worrying trend (bizcommunity.com)

Fourth-quarter retail figures suggest a slight sales recovery, but cash-strapped consumers are turning to credit to finance their purchases and new loan default rates paint a worrying picture.

Eighty20, a consumer strategy, analytics and research company, has released its Credit Stress Report 2022 Q4 in collaboration with Xpert Decision Systems (XDS).

“The interesting story in quarter four was the continuing and increasing appetite for credit, despite continued inflation and rising interest rates. While there were more than 800,000 new entrants into the credit market this quarter, the highest since Covid, it has come with a surging number of loans, notably credit card, vehicle and asset finance (VAF) and home loans, that are newly in default,” said Andrew Fulton, director at Eighty20.

800,000 new credit entrants

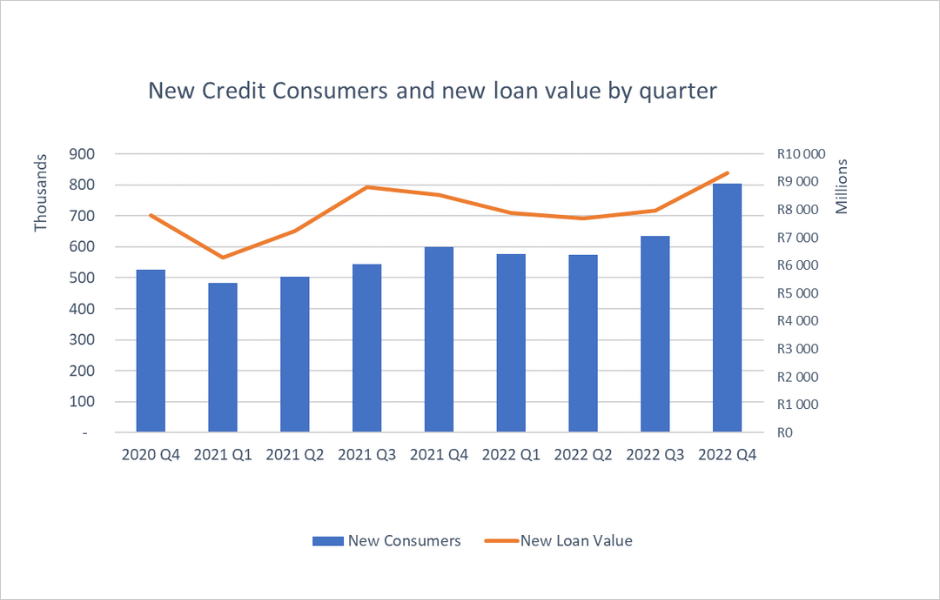

Total defaulters are down 2% and total overdue balances are down 11% from quarter four 2021. This is largely driven by significant write-offs of olds loans (particularly VAF) over the last year. Overall, there was strong demand for new credit with 800,000 new entrants to the credit market in quarter four, compared to 600,000 in the previous year.

These new entrants took out R9.3bn in new loan value, the highest in more than two years, and up nearly 10% on last year. There has also been a significant surge in credit card balances with total loan balances up R25bn (12%) YoY. This brings the total credit active population to 18.7m with total loans balances of R2.3tn.

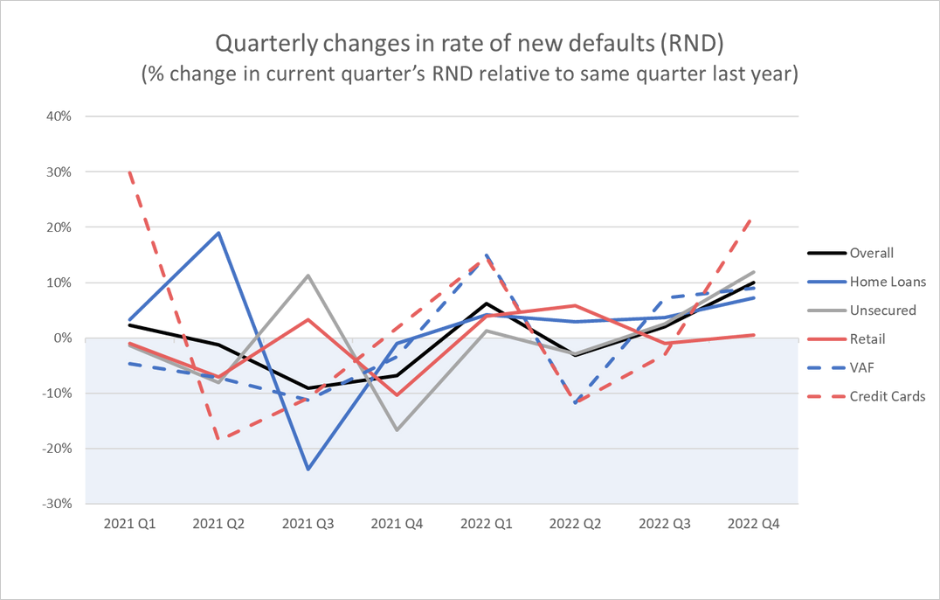

Despite this healthy growth, it is the Rate of New Defaults (RND), the proportion of current loan balances that went into default during the quarter, that is particularly worrying – sitting at 2.2%, up by nearly 16% compared with this time last year. The RND is an early warning indicator of the state of credit stress amongst South African consumers.

The change in RND is the percentage change in the current quarter’s RND relative to the RND in the same quarter the previous year. This sharp change in the RND is driven primarily by credit card, home loans and VAF loans with increases of 20%, 19% and 18% respectively (compared to -0.3%, 10% and 5% in quarter three).

Eighty20 said that credit card stress appears to be impacting most customer segments, while the impact of interest rate hikes is now visible among VAF and home loan products held by the middle market and South Africa’s wealthiest segment, heavy hitters.

Retail comeback

Despite the higher cost of living, rising interest rates, and near-daily blackouts, retail sales activity showed surprising resilience in the fourth quarter. The largest contribution towards this increase came from retailers in textiles, clothing, footwear and leather goods. Retail trade sales at current prices increased by 7.2% YoY in 2022, propelled by 200,000 people taking up R3.8bn in new retail credit for the first time this quarter.

However, Eighty20 said this growth does not look sustainable given the rapid increases in RND over the last quarter. Customers are either using credit to fund everyday expenses or are simply not able to service their growing loan instalments in the current high-inflation environment.

Mass credit market

The low-income segment earning between R3,000 and R8,000 per month appears to be increasingly reliant on credit for everyday purchases. Their credit card balances ballooned by R2.5bn this year, reflecting an increase of 23%.

A significant percentage of the 1.3 million credit card holders also moved into default in this quarter, with an RND of 4.9% – a 34.5% YoY increase.

Average instalments on all loans are up by 12.6%, bringing the instalment-to-income ratio to more than a third of monthly income (36.5%). The change in unsecured and retail loan RND are also both in double digits.

Middle-class workers

Middle-class workers (with an average personal income of about R15,000 per month) also appear to be needing credit card debt to help fund their lifestyle, but not with the same intensity as the mass market. Total credit card debt is up 10% over the year, with average credit card loan balances up 12% to R31,000.

Although the proportion of credit card loan value newly in default has increased by nearly 17%, the real concern is how this segment is starting to struggle to meet the growing instalments on VAF and home loans due to interest rate hikes. Despite almost no growth in VAF and home loan balances, quarter four saw high YoY increases in the RND for these loan types – 30% and 18% respectively.

The total average instalment to income ratio for the middle class has increased by 7.4% over the last year and is now sitting at 69.4% – meaning more than two-thirds of the average middle-class salary goes to servicing debt.

Heavy hitters

The credit stress Eighty20 is starting to see in the middle class appears to be even more pronounced for heavy hitters, South Africa’s wealthiest 5% of the population. The change in the value of all credit newly in default has risen dramatically during Q4, up 23.7% compared to 2.5% in Q3.

Home loans have created significant pain for consumers with a steep 25% YoY increase in average mortgage instalments due largely to rising interest rates. The 25-basis point interest rate hike on 26 January brought the prime lending rate to 10.75%, the highest it has been since 2009, and had the effect of increasing monthly instalments on a R1.5m loan taken out in 2021 by R3 400 in little over a year.

This pressure is noticeable. Quarter three saw heavy hitters experiencing an 18% increase in home loan balances going into default, while quarter four has seen that figure increase further to 24%

Heavy hitters have also seen a change in RND of 21% and 30% for credit card and VAF balances.

Students and scholars

Just over one million credit-active students and scholars make up less than 1% of the total credit market in South Africa. As would be expected from a segment experiencing credit for the first time, most likely with little to no financial education, their credit behaviour is worrying and volatile, said Eighty20.

This segment’s proportion of loan value newly in default has increased dramatically with 4.8% of all debt held by students and scholars going into default over this past quarter, compared to 2.2% for all credit-active South Africans. Those with retail and unsecured loans have particularly struggled – with an RND of 10.9% and 6.7% respectively. This is a 51% increase on the previous year for unsecured loans and a 29% increase for retail credit.

In conclusion, Eighty20’s Q3 Credit Stress Report outlined how rising interest rates and inflation appeared to be particularly impacting middle-class customers with VAF and home loans. Increased financial pressure in the market takes time before it is observed in default rates (more than 90 days in arrears).

“Now we are seeing the very real stress customers are feeling in all walks of life. If quarter four is a good indicator for the year ahead, it is unlikely that consumers will be able to continue to turn to retail therapy as an antidote for their economic blues,” Eighty20 said.

Download the Credit Stress Report

Roger McCallumr