Cautious optimism to be applied to the credit sector

Download the Credit Stress Report

Read the Daily Maverick article here: After the Bell: I owe, I owe, it’s off to the sea of household debt I go

Eighty20 has released its 2023 Q4 Credit Stress Report (CSR) in collaboration with Xpert Decision Systems (XDS) outlining developments in the credit sector as well as its impact on the economic landscape.

The 2023 Q3 analysis brought a glimmer of hope to South Africa’s credit sector for the first time in years. This optimism was short-lived as Q4 highlighted a blend of both positive and negative indicators with the unemployment rate increasing slightly, inflation creeping up, and consumer confidence dipping down again. Despite this, there was a significant improvement within the credit sector as the percentage of loans in arrears decreased by a full percentage point.

Our economy bounced back to its pre-Covid level in mid-2023, and Q4 saw a 0.1% growth in the economy (following a 0.25% decline in GDP during Q3 of 2023), meaning we avoided a technical recession. The UK has already slipped into a technical recession, and globally, the outlook remains bleak.

Below are a few Q4 developments:

- This was the first quarter since Q1 2020 where the average outstanding balances have seen a QoQ decrease. The decrease was 0.7% since the last quarter.

- Over the past two years, total loan balances for vehicle asset finance (VAF) among the Middle Class have been declining, resulting in 100,000 fewer Middle-Class individuals holding VAF loans during that timeframe.

- The total value of home loan balances experienced its first decrease since the onset of the Covid lockdown.

- In December, retail sales delivered a surprise by increasing 2.7% year-on-year (YoY) before inflation. However, overall, 2023 saw a 1% decline compared to 2022 in real terms. During this quarter, there were 1.25 million new retail loans.

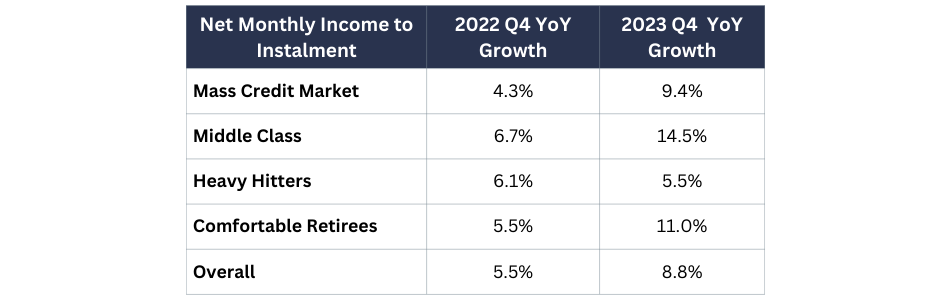

- The average ratio of monthly instalments to net income for all South Africans is currently at 47%, indicating that nearly half of the income of the average credit-active individual is allocated to debt servicing. Among the Middle Class, this ratio is nearing 80%, marking a 14.5% increase over the year.

Constrained Credit Market

All major listed banks acknowledged the impact of credit impairments on their 2023 financial results. African Bank revealed it had to double its provisions to account for bad debt, whereas Standard Bank noted that while its credit impairment charges had decelerated, they remained at elevated levels.

|

Consequently, banks and retailers are adopting stricter measures in extending credit to new customers, alongside writing off overdue debts. Interestingly, this trend could account for the second consecutive QoQ decline in the proportion of loans in arrears, currently standing at 36.4%, as banks eliminate bad debts from their records.

These observations mirror trends evident in the credit data. It is the first QoQ decrease in average outstanding balances since Q1 2020. Moreover, both the total open loans and the count of credit-active individuals experienced a marginal 1% QoQ increase. Concurrently, overdue balances exhibited a reduction of 0.5% QoQ, amounting to R188.6 billion.

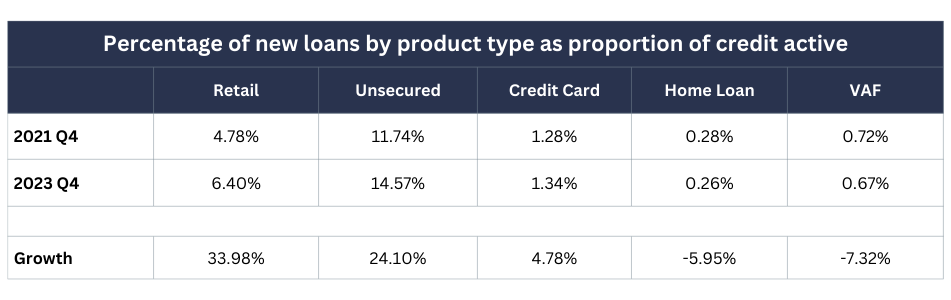

Unsecured loans are growing, while larger secured loans are not

There were more than 600 000 net new loans in the quarter, which reflected the trend of large loan products (home and car loan) typically reserved for Middle Class, Heavy Hitters and Comfortable Retirees shrinking significantly. Conversely, there was also robust growth across the retail and unsecured loan sectors.

As illustrated in the chart below, a percentage of new loans as a proportion of credit active individuals, home loans and VAF are down but there is a significant increase in both retail and unsecured loans.

Vehicle finance under pressure

Currently, there’s a noticeable decline in the number of people opting for Vehicle and Asset Finance (VAF) compared to 2019. Year-on-Year, VAF loan numbers have dipped by almost 1%. Total VAF loan balances have seen less than 1% growth each quarter over the last three quarters, culminating in a YoY growth rate of 3.8%. Concurrently, overdue VAF balances have decreased by 4% year-on-year.

This trend has particularly impacted the Middle Class, constituting approximately 30% of all VAF loans. Their loan balances have steadily decreased over the past two years, with a notable decrease of 100,000 individuals with VAF loans in this segment during that period.

Passenger vehicle sales have also experienced a decline, with year-to-date figures in December 2023 showing a decrease of 4.4% compared to 2019. January hasn’t shown any improvement either, with new sales down by 3.

The decrease in VAF financing and new car sales has opened up opportunities for companies like WeBuyCars. They report receiving approximately 14,000 credit applications per month and aim to transition cash sales into formal credit channels. Some of these cash sales currently involve loans from family, friends, and informal lenders, suggesting a potential benefit in formalizing this process. With inflation exacerbating the already high costs of new cars (as highlighted in a recent TopAuto article revealing that nearly three-quarters of all new cars in SA now exceed half a million rand), there is significant potential for growth in this market.

Home loan market is also struggling

While there has been a 6.4% growth in home loans by value YoY, the total value of home loans decreased this quarter for the first time since the Covid lockdown. The number of home loan holders has grown 1% YoY, with the number of home loans growing 1.7%. Average Instalments on home loans are up 13%, and overdue balances up 56% YoY.

|

There are roughly 200 000 new home loans issued per year in South Africa. The rate at which new loans are being issued has been dropping, with new home loans as a percentage of credit active individuals showing a decrease of nearly 6% over the last 2 years. This is unlikely to change until interest rates come down, presumably in mid-2024.

Nalen Naidoo, General Manager of Property24 explains: “The increases in the repo rate in 2022 and 2023 have had a cooling effect on property transfers. Based on an analysis of Deeds Office data, we estimate that the year-on-year erf and sectional scheme transfers are down 15% in terms of value and 20% in terms of counts.” This includes all property types (including commercial) and is transfers, not loans.

Retail loan performance proving to be resilient

The overall number of retail loans grew by 441 000 this quarter to nearly 25m retail accounts held by roughly 14m individuals. The YoY growth in the number of retail loans is at 4%, and by value 9% over that same period.

In December, retail sales experienced an unexpected surge, rising by 2.7% YoY in real terms. This upturn helped offset a lacklustre performance during the Black Friday period. The primary contributors to this growth were retailers specializing in textiles, clothing, footwear, and leather goods. However, despite this positive development, retail sales for 2023 overall were down by 1% compared to 2022 in real terms.

Instalment to income ratios continue to surge

What strategies are South Africans employing to prevent defaulting on their debt? According to the data, the average instalment-to-net monthly income ratio has been on the rise since the third quarter of 2021. These increments are significant and are outlined by segment in the table below:

These trends are fuelled by stagnant income growth and individuals responding to inflationary pressures and rising interest rates by seeking larger unsecured loans. It’s important to exercise caution when drawing conclusions, as the debt-to-income ratio relies on predicted income, which may be less precise for both high-income earners and those with lower incomes, often reliant on cash transactions.

According to a recent Businesstech article, over the past seven years, average take-home pay has increased by just 1%, while inflation has surged by 40%. To cope with this financial strain, people have increasingly turned to retail loans for clothing and homeware purchases, relying on unsecured loans and credit cards for other expenses. Notably, credit card balances have demonstrated double-digit year-on-year growth for 8 out of the last 10 quarters, peaking at 15% in mid-2022.

“As we step into 2024, the outlook is still fragile, but it may not be as bleak as some might think. Echoing the sentiments of Adrian Gore, CEO of the Discovery Group, often the narrative about South Africa is significantly worse than the reality. There are signs of improvement, and with cautious optimism, we can navigate towards a brighter economic future,” concludes Eighty20.

Download the Credit Stress Report