Covid and the Consumer

At Eighty20 we are passionate about helping our clients create value by using data properly. With the Covid-19 pandemic, everything is changing rapidly and it is essential to understand not only the impact on people, but the best response to this crisis. Our deep understanding of consumer behaviour, extensive analytics capabilities and well developed actuarial modelling and scenario planning techniques are being used to help our clients respond in the best way – serving their customers and ensuring sustainability. Our pragmatic approach to insights, problem solving and execution helps provide clarity and focus in uncertain times – that’s using the Eighty20 principle. #CovidClarity

School’s Out, Screens On

While 13 million SA children were locked down, the HouseParty and TikTok apps ranked in the top ten most downloaded apps (according to SimilarWeb). Users spend, on average 2 hours and 15 minutes per day on these two apps alone. A 2019 “Adolescent Brain Cognitive Development” study in Canada found that children who kept screen time under 2 hours a day were “less impulsive”.

(https://bit.ly/3aWEQfy, https://bit.ly/3c7HsaK, https://bit.ly/2wqcYBo, https://bit.ly/39OVCMg)

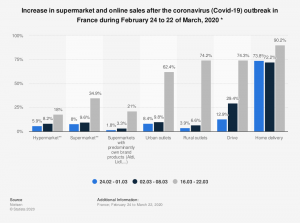

French E-commerce

France, like South Africa is currently under full lockdown. Home deliveries in France have increased by 90.2% from the 16th to 22nd of March 2020, compared to the same weeks the year before. In 2017, approximately 60% of French consumers engaged in e-commerce, compared to roughly 30% of South African consumers in 2019.

(https://bit.ly/2JPFBLu, https://bit.ly/2XhlFca, https://bit.ly/2x3jm1Z)

Lockdown Violence

During the first week of the COVID-19 lockdown, the South African Police Service received 2,320 complaints of gender-based violence. This is 37% higher than the weekly average during 2019. Similarly, during the first two weeks of lockdown in Spain, the emergency number for domestic violence received 18% more calls than it did in the same period a month earlier.

(https://bit.ly/2wmKN6v, https://nyti.ms/39LibBq)

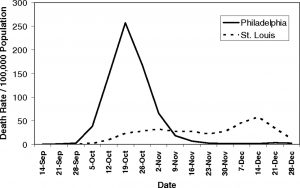

A Tale of Two Cities

During the 1918 Spanish Flu pandemic, two US cities had very different responses to the outbreak. St Louis cancelled all events and gatherings after discovering its first cases, while Philadelphia went ahead with a military parade attended by 200,000. Philadelphia had a cumulative death rate over the period of 719/100,000. This compares to St. Louis which had a cumulative death rate of 347/100,000. The graph shows how drastically different the peak number of deaths were for the two cities.

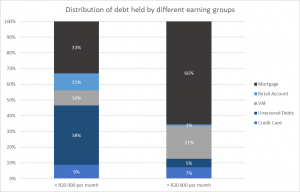

Capitec Credit

From December last year, Capitec has lost R79 billion in value, and some economists have raised concerns about the bank’s exposure to at-risk consumers. Capitec has stated its client base has seen migrations to the middle and higher income segment. In addition, they state that 47% of credit granted has gone to customers that earn more than R20k pm. Amongst South Africans, only 12% of all consumers who hold unsecured credit earn more than R20k pm.

The Credit Amendment Act signed in 2019 allows applicants earning less than R 7 500 per month and unsecured loans of less than R50 000 to apply for some form of relief on their unsecured debts. This had direct implications for Capitec, as their client base has traditionally been low to middle income groups who were enticed by low cost transactional banking products. Since the passing of the Credit Amendment Act, it is likely that Capitec and other banks and credit providers have been more prudent in accepting credit for individuals earning less than R 7 500 per month.

According to Capitec, of a total of 12.6 million customers, only 1.1 million have taken credit with the bank (about 9%). Just over half of the credit granted by Capitec in August 2019 was to clients with a gross salary below R 20 000, most of whom hold retail accounts and unsecured credit accounts. Customer default rates, according to our credit stress report 2019 Q4, for customers earning >R20k pm, is less than 20%. Customers earning

The chart below shows the distribution of outstanding balances on credit products between individuals who earn R20k pm.

Debt held by higher earners tends to be used to purchase long-term tangible assets such as houses and cars, although there is still short term unsecured debt. It is likely that lower earning individuals struggle to qualify for larger loans such as Mortgage and Vehicle Asset Finance. Lower earning consumers have a larger portion of debt attributed to credit cards and retail accounts. There is also concern that customers who earn less, use debt for everyday consumption expenditure

Low income customers with Capitec and other banks are facing difficult times as the financial effects of the COVID-19 crisis add strain to an already challenging environment.

(XDS Credit Data, 2019 Q4, https://bit.ly/2UIo4v7, https://bit.ly/2xOl8Ul, https://bit.ly/2X80DwG)

Gen-Xers and COVID-19

Credit held by consumers in the Gen X age group (those aged 39 to 54) may be disproportionately affected by the COVID-19 pandemic. The XDS credit data shows that Gen Xers represent more than 30% of credit active consumers in South Africa, but only make up 16% of the South African population as a whole. (XDS Credit Data, 2019 Q4)

The global COVID-19 pandemic has created a generational rift on social media and elsewhere. Individuals in groups which are less vulnerable to the virus such as Gen Z (those younger than 24) and Millennials (those aged 25 to 38) are being called out online for not adhering to lockdown protocol, and in so doing putting older generations at risk.

It is widely believed that COVID-19 might be the crisis that will be the defining moment for Gen Z. For Gen Xers (those aged 39 to 54) it was the end of the Cold War, the fall of the Berlin wall, the rise of personal computing, and feeling lost between two huge generations, namely Baby Boomers and Millennials. However, unlike previous generation-defining events such as 9/11 and the Great Depression, this event has directly and immediately impacted individuals’ lifestyles globally. The global pandemic will likely be the formative moment that will shape the worldview of Gen Z, and consequently their future financial behaviour.

The Eighty20 XDS Credit Portal can be used to examine the behaviour, on a quarterly basis of all South African credit active consumers. The 2019 Q4 data shows that Gen Xers represent more than 30% of credit active consumers in South Africa, but only 16% of the South African population overall. Unsurprisingly, they are the most leveraged age group with the highest instalment to net income ratio at just under 50%. Gen Xers are in their middle years, and are likely at peak financial stability. As a result, some have dual financial responsibility over their children and aging parents. These commitments may limit their ability to absorb financial shocks that will arise as a result of the COVID-19 crisis.

(XDS Credit Data, 2019 Q4, https://bit.ly/2UTFa86, https://nbcnews.to/2RkNQU7)

Mining and Construction

Consumers in South Africa hold approximately R 2tn in current and overdue debt. R 1tn of this can be linked to consumers employed in identifiable sectors. Consumers employed in the Mining Sector hold approximately 7% of this R 1tn, while their counterparts in the Construction Sector hold around 4% of the R 1tn. With many of these consumers unable to work during the lockdown, it is likely that a portion of this debt will go into default.

Two groups who are likely to be hard hit by the national lockdown are people who work in the mining and construction sectors. Like all sectors in South Africa, individuals working in these sectors are very likely to have debt, some of which is already in default. In the last quarter of 2019, people working in the Mining Sector held about 7% of all debt held by all consumers whose sectors were identified, while their counterparts in the Construction Sector held 4% of all debt held by consumers whose sectors were identified. These consumers held 8% and 5% of all overdue debt held by consumers whose sectors were identified respectively.

Currently all non-essential services are suspended as per national lockdown regulation. Construction and mining fall into this category. Many people working in these industries are shift workers who will likely receive no salary during the lockdown. Furthermore, given that the physical presence of many of these workers is required on site to fulfil their work, it is unlikely that work from home strategies are feasible. However, consumers in these sectors who fulfil certain roles may be able to do so. For example, an individual who prices construction projects may be able to crunch numbers on a laptop from home.

The XDS Credit Data available on Eighty20’s Data Portal provides statistics on the debt held by South African consumers and can be grouped by age, industry, and income level. By using this data for the last quarter of 2019, we found that 29% of loans held by consumers working in the Mining Sector are at least one month in arrears, with 13% being more than nine months overdue. 34% of loans held by consumers working in the Construction Sector are at least one month in arrears, with 15% being more than nine months overdue.

Consumer Debt

The Eighty20 XDS Credit Portal has identified sectors of work for 7.5 million credit active consumers in South Africa. Of these consumers, The Public Sector (excluding the Health, Parastatal and Police and Army Sectors) employs the most at 1.2m people, who collectively hold R17.4bn in overdue debt. (XDS Credit Data, 2019 Q4)

The Eighty20 Credit Portal allows users to analyse XDS Credit Bureau data on a quarterly basis. The 2019 Q4 data shows the distribution of credit active consumers working in each sector, and we can infer the impact the national lockdown will have on each sector.

Of the 7.5 million credit active consumers whose employment sectors were identified, the Public Sector (which excludes the Health Sector, Parastatals and the Police and Army Sector) employs approximately 16% (~1.2m) of the total. A further 17% (~1.3m) are Students, Retired, or House-spouses. The Formal Sector is the next largest sector, with 10% (~740k) of credit active consumers.

In 2019 Q4 there was ~R71 billion in overdue debt that belonged to consumers whose sectors could be identified. Of this debt, 8% is with Mining employees, 5% with Construction workers, 5% with Student/Retired/House-spouse, 3% with Retail employees, 1% each with Fast Food workers and Domestic and Gardening workers. We anticipate that the national lockdown will result in financial strain across all sectors, but more so in those with lower income employees, or in those which require physical presence. A total of 23% of the R71bn overdue debt is held by these 6 groups, which will be under pressure in the next weeks and months.

Indebted Sectors

Excluding unidentified sectors, employees in the Public Sector (excluding the Health, Parastatal and Police and Army Sectors) held the most debt in 2019 Q4 by current balance. These employees held almost 100% more in current balances than the employees in the second most indebted sector, the Financial Sector. (XDS Credit Data, 2019 Q4)

The Eighty20 Credit Portal allows users to analyse XDS Credit Bureau data on a quarterly basis. The data shows in which of 19 sectors people are employed. Consumers who are identified to work in the Public Sector (but not the Health, Parastatal or Police and Army sectors) held more than R229bn in current balances on their loans in 2019 Q4.

The sector that held the next highest total current balance was the Financial Industry, which held almost R116bn in current balances on their loans. Effectively, the Public Sector held 98% more than the Financial Industry. If the Parastatal and Police and Army sectors are included, the Public Sector held a total of R295bn in current balances.

The lockdown in response to the COVID-19 pandemic may put repayment of these balances at risk, as the reduction in economic activity reduces consumers’ ability to make payments on their loans. The risk is higher with consumers who spend a large proportion of their net income paying off their debt. One sector that has a high instalment to net income ratio is the Self-employed Sector, with an instalment to net income ratio of 0.75. This indicates that they spend 75% of their net income paying off their debt, and puts them at high risk of not being able to meet their obligations during the lockdown.

Other consumers at risk are those who work in the Financial Industry as well as those who work in the Fast Food Sector, as these groups have average instalment to net income ratios of 0.67 and 0.64 respectively.

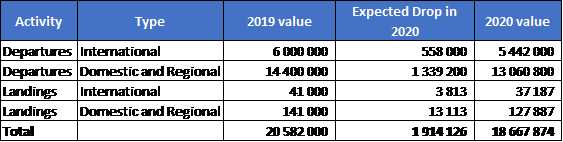

Covid-19 puts brakes on air travel

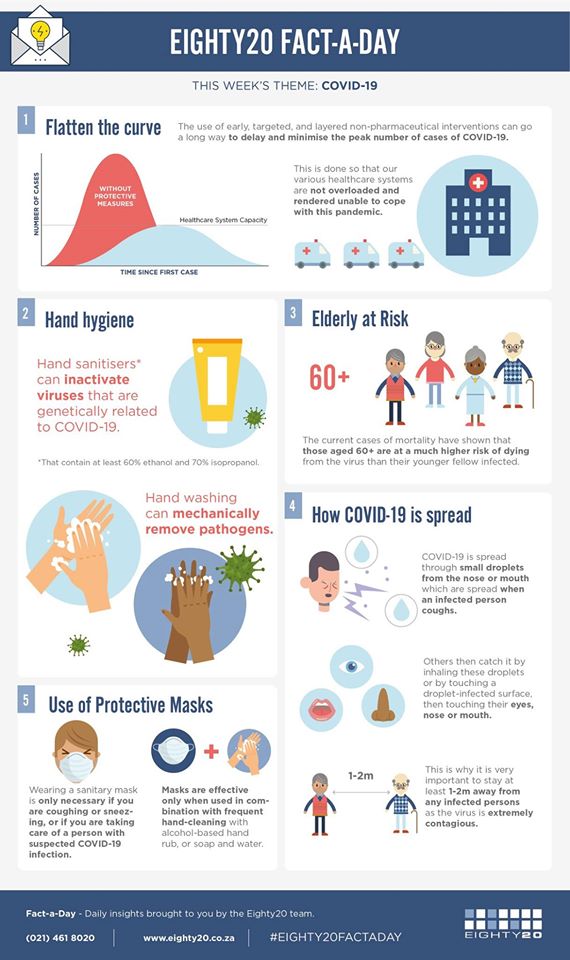

The airline industry has been heavily impacted following the outbreak of COVID-19. The global scheduled flight capacity had dropped by 12.4%(YoY), as of 16 March 2020. The largest contraction was in Hong Kong, where capacity dropped by approximately 81%(YoY), followed by Italy with a drop of approximately 74%(YoY). In South Africa all domestic and international flights were shut down on 26 March 2020 for 21 days.

According to the Airports Company of South Africa (ACSA), in 2019 South African airports handled 6 million international departing passengers and just over 14.4 million domestic and regional departing passengers. Over the same period, ACSA recorded approximately 41 000 international landings, 10 000 regional landings, and 140 000 domestic landings. The total number of landing and departing travellers was just over 41 million in the 2018/19 financial year. OR Tambo is the largest and busiest airport in Africa with a total of over 21 million passengers in 2019. Cape Town International Airport is the next largest in South Africa with 11 million passengers in 2019. Despite these high numbers, in terms of individuals, there are fewer than 5m people in South Africa who have ever been on a plane.

These numbers will be impaired in 2020 by the COVID-19 pandemic, particularly during the 21 day national lockdown. In South Africa all domestic and international flights were shut down on 26 March 2020 for 21 days.

If we use the most recent global drop in flight capacity as an estimate of the expected drop for the rest of the year, as well as some other calculations, we get the following estimates:

This issue is a complex one, and using a range of approaches is advisable in such circumstances. We could use flight data we have available for countries which have already implemented a national lockdown as a rough estimate. For example, a 74% (YoY) drop in flight capacity was observed in Italy following their national lockdown on 9 March 2020. If we assume that this drop remains consistent for the next nine months, we can perform similar calculations to estimate the loss in flight capacity for South Africa. Using this approach we get the following results.

This estimation is far from perfect. From a regulatory perspective both lockdowns have some key differences where flights are concerned. Italian airports remained open, and many flights continued. Flights from China and Taiwan were suspended, as well as domestic travel. South Africa has employed a more stringent approach by prohibiting all flights in and out of South Africa including transits.

Both of these forecasting approaches have their flaws, as do all forecasting methods. As with much of our reality amidst the ongoing COVID-19 crisis, there is a great deal of uncertainty surrounding the topic of flight capacity for South Africa. At Eighty20 we aim to alleviate this uncertainty by using data.

If you are interested in learning more about Eighty20 and our insights, check out our other blog posts.

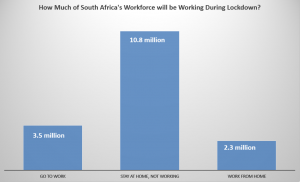

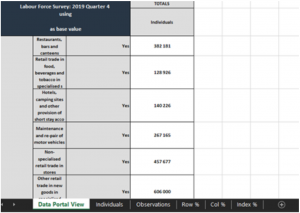

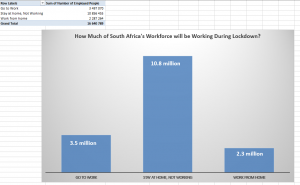

Sitting at Home

Using the Labour Force Survey for the last quarter of 2019, the information so far available as to who will be allowed to go to work during the shutdown, and some educated guesswork, we expect 13.1 million employed South Africans will be staying home during the three-week shutdown. Of those at home, 2.3 million (17.5%) should be able to work from home leaving 10.8 million employed South Africans out of the workforce for 3 weeks. (Labour Force Survey – 2019 Q4, https://bit.ly/2Unf8ep)

We expect 13.1 million employed South Africans will be staying home during the three week lockdown from 26 March to 16 April, 2020. Of those at home, 2.3 million (17.5%) will be able to work from home, leaving 10.8 million employed South Africans out of the workforce for 3 weeks.

To get these numbers we used Eighty20’s Data Portal to access the Labour Force Survey conducted for the last quarter of 2019. In this blog post we are going to walk you through how we did it.

The Eighty20 Data Portal is a tool which allows you to draw insights from South Africa’s richest datasets from various fields and sources. You don’t need to be an expert to use our data; we make it simple and accessible. We’ve done the heavy statistical and methodological work, so that you don’t have to.

Allow us to give you a step-by-step tour of our Data Portal to show you how to get today’s Fact-a-Day.

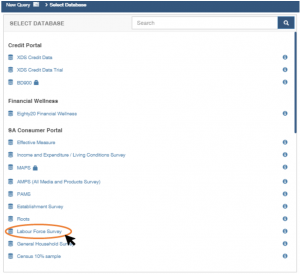

- Choose from our wide range of datasets

The Data Portal includes access to demographics, product and brand attitudes, financial habits, credit rating and online behaviour within the population, as well as so much more. Whatever business you’re in, we have the data necessary to inform key decisions. For today’s analysis we chose the Labour Force Survey.

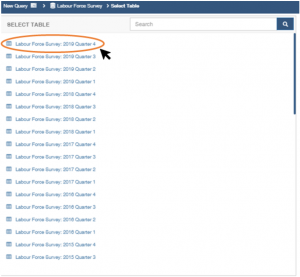

| 2. Choose the version best suited to your needs

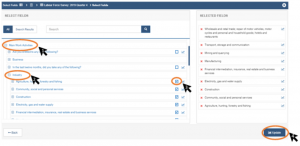

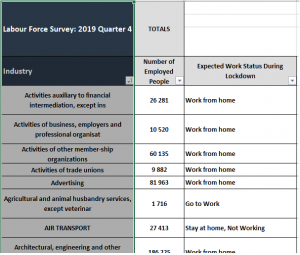

We have data stretching as far back as 2007 for the Labour Force Survey, and some pretty impressive historical data for other surveys too. For this analysis we needed the most recent available data (2019 Quarter 4). 3. Choose the survey questions you’re interested in by selecting fields. We needed to figure out how many people are working in each industry. This can be found in the “Main Work Activities” field under “Industry”. The Data Portal interface allows you to access this data in just a few clicks.

6. Now for the analysis As detailed as the Labour Force Survey is, it doesn’t survey who will and won’t be at work during the lockdown, so that we had to do manually. We added a new column to our Excel worksheet to categorise each sector as “Go to Work”, “Stay at Home, Not Working”, or “Work from Home”. We used this article from Business Insider for an idea of which industries will and won’t be going to work. There was some educated guesswork involved in deciding whether people from these industries could work from home or not. For example, we categorized ‘Mining of iron ore’ as a job one cannot do from home and ‘Software consultancy and Supply’ as a work from home occupation. This is not an exact science; of course the CEO of an iron mine will be very busy talking to shareholders during the lockdown, and if you install software on site for a software consultancy, you might not be able to do that remotely.

And voilà! Our Fact-a-day analysis is complete. Interested in a free trial? Get in touch with us here. If you do some interesting analysis why not send it to us? If we like it we might post it on this blog. |

|||||||||

|

Change in consumer behaviour

There were 1.8bn global online shoppers before the outbreak of COVID-19. After the outbreak, shopping in physical stores has seen a decrease (estimated to be approximately 30%) while online could see an increase of around 10%, according to a PYMNTS.COM survey done in the USA on 6 March 2020.

There were 1.8 billion global digital buyers in 2018. Estimates are that by 2021 there could be 2.14 billion digital shoppers around the world.

However with the outbreak of COVID-19, many consumers are rapidly migrating from traditional brick and mortar stores to online stores.

PYMNTS.COM, is a B2B platform for the payments industry and source of information about the initiatives that shape the future of commerce. On 6 March 2020, they conducted a survey to a panel of more than 2100 US consumers which found that online shopping had increased 10.5% via desktop/laptop and 7.7% via mobile phone since the COVID-19 crisis. Shopping in physical stores had decreased by 28.3%. Millennials saw the largest increase (13.6%) in switching to online shopping via desktop/laptop, while Gen Z were the largest increase in shopping via mobile phone (10.6%).

The pandemic has affected low-income consumers as they avoid shopping in physical stores, decreasing by 32.5% after the start of the crisis. Low-income consumers increased their online shopping by 8.9%, compared to an overall increase of 14.1% for high-income consumers shopping online.

In terms of gender, men spend 68% more money shopping online than women in the USA. Some 40% of men felt that the news was impacting what products they bought compared to 34% of women. Men were buying more groceries (22%), personal care items (14%), health and household products (13%) and beauty products (7%). Survey statistics provided by Forbes. Statistics provided by Statista

Contagion Hotspot

Over a quarter (4.2m people) of South Africa’s workforce use a minibus taxi daily in order to get to their jobs. Additionally, more than 1 million students use a taxi everyday to get to and from school. The transportation sector employs roughly ~387,000 drivers, with more than half of those (221,000) belonging to the informal transport sector such as minibus taxi drivers.

Everyday in South Africa, more than a quarter of the approximately 15.5m workers take a taxi to work, and another 13m travel in a minibus taxi in any given week.

Confined and crowded environments people visit daily can act as hotspots for spreading disease. With 16 people packed into each vehicle, social distancing is not an option, and a huge cause for concern with an outbreak as contagious as COVID-19. The infection possibilities are further exacerbated by the fact that cash is passed by hand from each commuter.

In terms of drivers, there are several hundred thousand taxi drivers, most of whom will be financially affected in the government enforced 21-day lockdown. The taxi industry has tried to curb the spread of disease through measures such as cleaning and disinfecting taxi ranks and vehicles everyday. Passengers are offered hand sanitiser as they enter and leave taxi ranks.

Ageism and COVID-19

South Africa has the highest of proportion of elderly people in the African continent. The South African mid-year population estimate indicates that the proportion of elderly (60 years and older) in South Africa is growing, reaching 9% (5.3 million) in 2019. Of the elderly, the highest percentage 24% (1.3 million) reside in Gauteng and the majority are female (60%). Medical aid penetration among the elderly is particularly low amongst the black (7%) and ‘coloured’ population groups (16.6%).

While nearly half of South Africa is under the age of 25, there is also a large number of older people (aged 60+) in the country. More than a quarter of all white South Africans are older than 60, and South Africa has the highest proportion of elderly people in its population in Africa. This is a cause for concern in the midst of the COVID-19 pandemic for two reasons. Firstly, the data that has come out of China and Italy suggests the elderly are most vulnerable to the worst effects of the disease. Preliminary data indicates the mortality rate for older people is much higher (10-27% for people aged 65-84 years, vs <1% for people aged 20-54 years). The second concern is the large number of multigenerational families in South Africa. In South Africa, 14% of households have 6 or more people, and we can assume that there are often grandparents in these shared households.