Credit Stress Report 2022 Q3 is out

Download the Credit Stress Report

The Eighty20 / XDS Credit Stress Report highlights the impact of economic forces on the South African consumer, with particular focus on consumer credit behaviour. All credit data in this report was sourced from the Eighty20 / XDS Online Credit Portal.

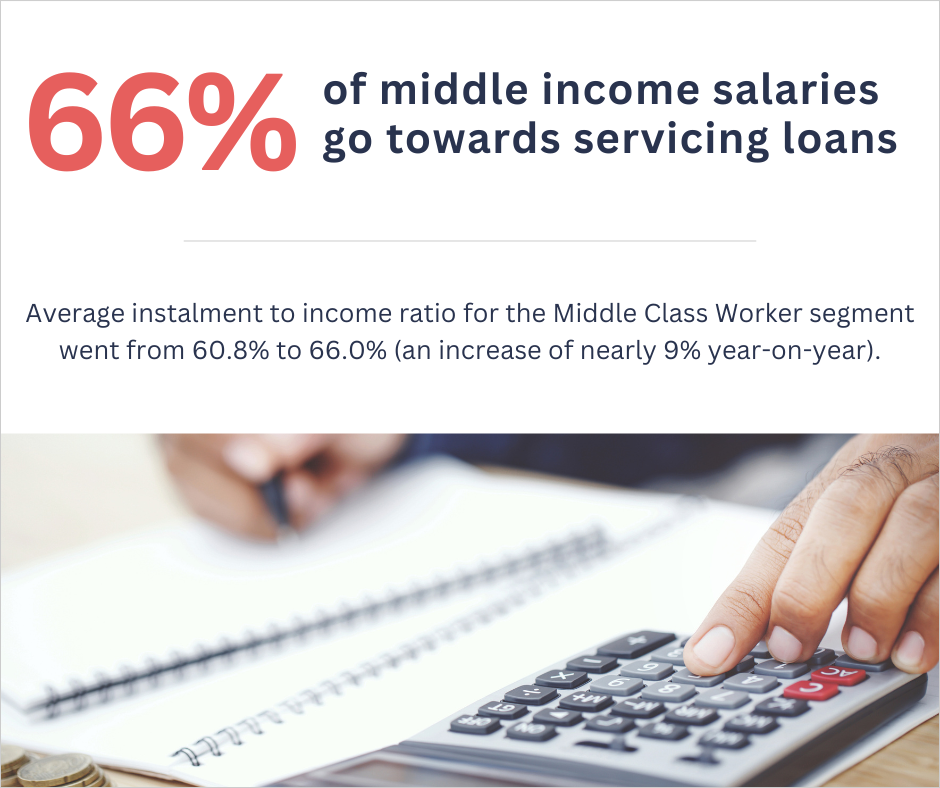

In the 2022 Q3 report we see signs of rising credit stress among South Africa’s middle income consumers.

In addition to the most recent interest rate change on 24 November, South African consumers were hit with two rate hikes in Quarter Three. With the Prime Lending Rate 3.25% higher than this time last year, someone with a R1.5m home loan (which will get you a one-bedroom flat in Cape Town City Bowl) has to find an additional R3,000 per month just to cover their instalments.

The report unpacks how economic forces are starting to put significant financial pressure on South Africans, particularly middle income consumers with vehicle finance and home loans. It might be a tough Christmas for some.

Download the Credit Stress Report

The credit data used to compile our Credit Stress Reports is taken from the Eighty20 Credit Portal. This online data tool allows you to analyse the credit behaviour of ~18.7m credit-active South Africans and ~49m loans. Click here for more information on the Credit Portal.