Generational Credit Trends: Insights from Millennials to Boomers

Watch the eNCA interview here: Discussion | How credit evolves at different life stages – eNCA

Download the Credit Stress Report

How credit evolves at different life stages

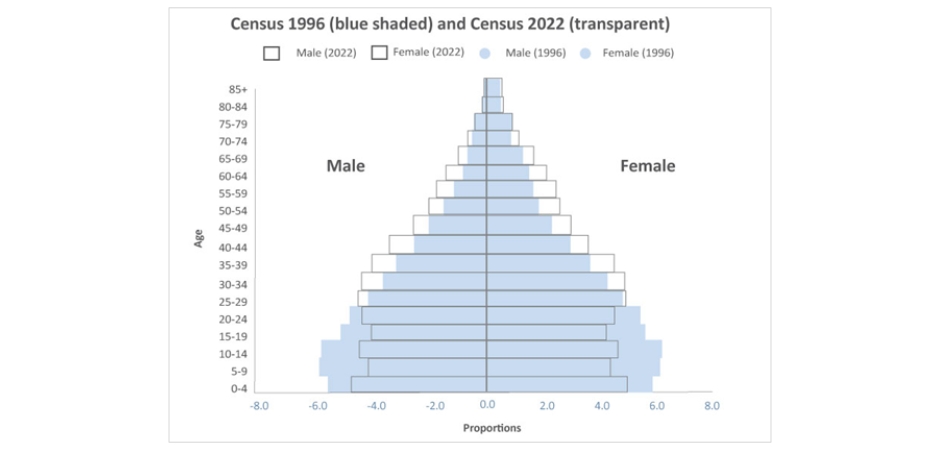

StatsSA’s latest data reveals a rising median age in South Africa. For the white population, the median age rose from 33 in 1996 to 45 in 2022, while the black African population remained younger at 27. Nationally, the median age increased from 22 in 1996 to 28 in 2022. Additionally, the percentage of South Africans aged 60+ grew from 7% in 1996 to nearly 10% in 2022, with about 30% of the white population now aged 60 or older.

The population pyramid below highlights this aging trend

Eighty20 Consulting, a consumer insights and data science company, explores how this demographic trend will impact various aspects of South African life, focusing on its effects on the credit industry.

Credit in South Africa

South Africa’s shifting demographics are set to influence various sectors, including the credit industry. Currently, nearly 20 million South Africans hold around 51 million loans, with total outstanding balances at R2.5 trillion, a 3.2% year-on-year increase. Credit card growth is up nearly 6%, and retail credit balances rose almost 4%. However, overdue balances have hit R200 billion, representing 8% of total debt, a rise of R11.5 billion in the past year. Credit is becoming increasingly concentrated, with loan balances growing at a 5% compound annual growth rate (CAGR) since 2021, while the number of credit-active individuals has only increased by 1.4%. Home loan balances are growing over 50 times faster than the number of home loan holders.

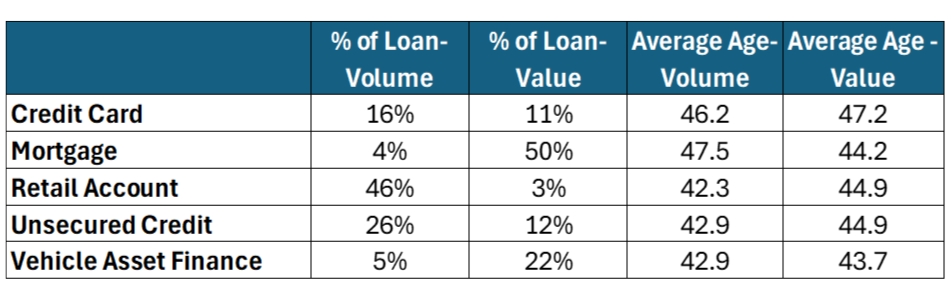

Value and volume of credit products by average age

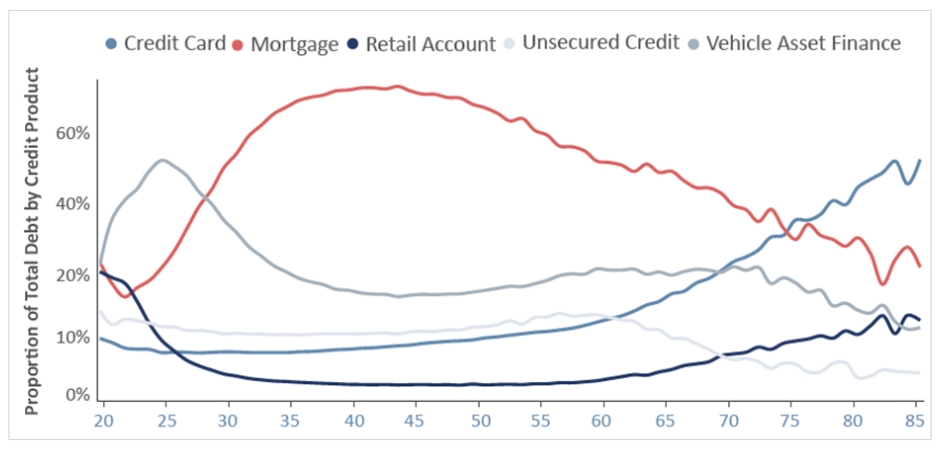

Proportion of total debt by age for each credit product

Credit holdings vary significantly across age groups, reflecting differing financial priorities and access to credit. 60% of the population younger than 35 years old hold only 17% of all outstanding credit by value, mostly in the form of unsecured debt – retail, personal loan and credit card.

Cars vs Houses

People get into VAF early (in their mid-20s,) but home loans rapidly take on a larger percentage of their debt load as they move into their 30s.

Young professionals, often unable to afford property in their preferred neighbourhoods and needing transport for career growth, typically enter vehicle asset financing (VAF) at an early age. By 30, around 12% of the credit-active population holds VAF, with this percentage remaining stable until their 60s. In contrast, home loan holdings reach 12% of credit-active individuals in their mid-30s, grow rapidly through their 50s, and decline after retirement around age 65.

Interestingly three quarters of those earning more than R60,000 per month have VAF, whereas only 60% of those people have a home loan.

Loan value by credit product and age

As people age, the distribution and size of their credit holdings also change. There are very low outstanding balances for those younger than 25 as well as those older than 65 (5% of credit by value). From age 25, VAF becomes an increasingly large part of the credit basket, with home loans following thereafter.

For all credit, there is a steep rise in credit acquisition that tops out between the ages of 35 and 45 (this cohort holds two fifths of all credit).

Credit journeys

Life events significantly impact credit holdings, with milestones like moving out, starting tertiary education, landing a first job, getting married, and having children all driving credit needs. By retirement, people often downsize their vehicles and homes as their children move out.

For the credit-active population, over 80% of those under 25 hold retail credit, typically their first credit product. Banks often recommend using a retail credit card to build a credit history before applying for vehicle asset financing (VAF) or a home loan.

Unsecured debt becomes dominant after 25, with over 32% of 26-year-olds holding it. By 30, 12% have VAF, though this never exceeds 13% across age groups. Credit card ownership surpasses 40% in their 50s, where home loans peak around 20% penetration. While home loans and VAF decrease post-retirement, credit card, unsecured, and retail credit remain prevalent throughout life. Rising living costs and inadequate retirement savings have led some retirees to maintain or even increase credit exposure, especially through credit cards.

As we have seen, life stage and age have a large impact on credit holdings and the amount of debt people are carrying. Credit scores are also impacted by age, and there is a direct correlation with a higher (better) credit score and age. This is both a function of your credit holdings, time in the credit market, and your payment behaviour. Maintaining a good credit history is key to being able to use credit wisely to acquire wealth, storing assets like houses, or buying assets like vehicles that enable you to make a living. “Sadly, too many South Africans ruin their credit scores at a young age by defaulting on unsecured or retail loans, probably not understanding (or not caring about) the long-term consequences. 40% of all defaulters are people under the age of 35. However, with 38% of overdue balances sitting with Gen X (45 – 60-year-olds) maybe it isn’t only age,” concludes Eighty20.