South African alcohol insights reveal distinct preferences and celebratory trends

Read the Retail Brief Africa article here: South African alcohol insights reveal distinct preferences and celebratory trends

As the festive season approaches, alcohol becomes a more central part of gatherings and celebrations in South Africa, a country with one of the highest alcohol consumption rates globally. For retailers, leveraging insights into how customers engage with this category can lead not only to increased share of the alcohol basket, but can also enable significant opportunities to grow share of wallet across other adjacent categories during this peak season.

Eighty20 Consulting is a consumer insights and data science business helping brands find customer-led growth. Using MAPS, a survey of 20,000 South Africans by the MRF as well as YouGov data, a segmentation and media planning tool from KLA. We analyse the unique preferences of South African alcohol consumers by unpacking some of the insights and mining secondary data – a valuable source of market understanding allowing companies to gain insights quickly, efficiently and cost-effectively.

In response to increased competition from Checkers, Woolworths aims to strengthen its alcohol offerings, with a particular focus on female consumers. Woolworths reported that while their customers have substantial alcohol budgets, many currently spend with competitors. The retailer aims to attract these customers by aligning their alcohol range with the high standards of quality and customer service associated with the Woolworths brand. According to YouGov data, although alcohol consumption skews towards men, who make up 60% of the market, Woolworths shoppers who purchase alcohol frequently – whether daily or multiple times a week – show no significant gender difference. This insight supports Woolworths’ focus on female customers.

|

The MAPS data shows that half of South African adults consumed alcohol in the past month, with beer the top choice, particularly among men (72% of weekly beer consumers are male). But there has also been a notable rise in non-alcoholic beverage options, with nearly three-quarters of a million (5% of adults) South Africans saying they consumed non-alcoholic beer, cider or gin in the past seven days. Interestingly, only a few (5%) of these consumers abstain from alcohol altogether.

There are other interesting skews in terms of demographics. Single and divorced people are more likely to drink than their married counterparts. Younger generations, particularly Generation Y (average age 34), are more likely to drink than Baby Boomers (average age 66), at 56% versus 37%. Preferences vary by income, as wealthier consumers favor drinks like cane, cognac, and whisky, while lower-income segments are more likely to purchase budget-friendly options such as boxed wine. Age also influences alcohol choice: the average cane drinker is around 44 years old, while alcoholic energy drinks attract a younger demographic, with the average consumer roughly 10 years younger.

Celebrations and Milestones

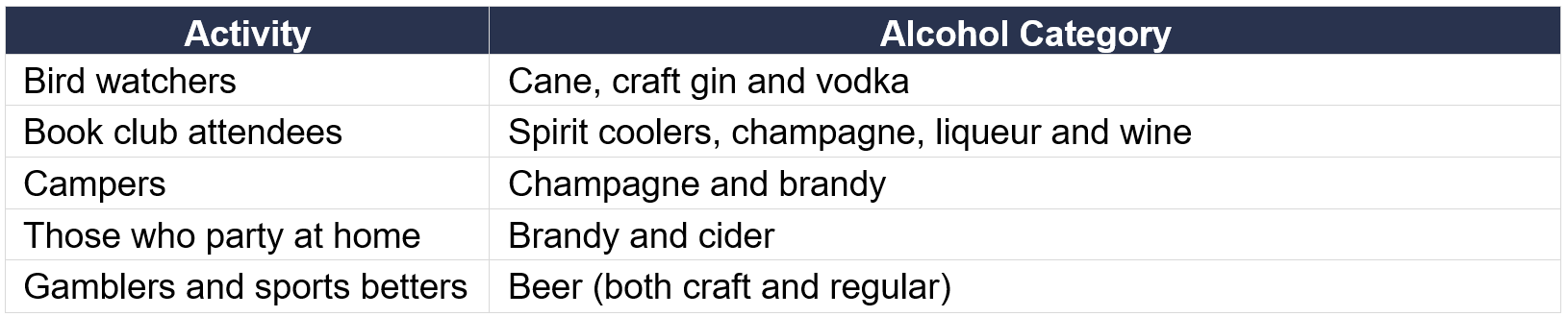

There are numerous ways to segment consumers. Occasion segmentation categorizes consumers based on specific occasions when they use a product or service. Aligning products with the situations in which customers might use them helps to personalise and enhance relevance. Specific alcohol categories are over indexed for certain activity and interest groups, outlined below (which might not necessarily mean they consume the category during the activity, but the two are strongly correlated).

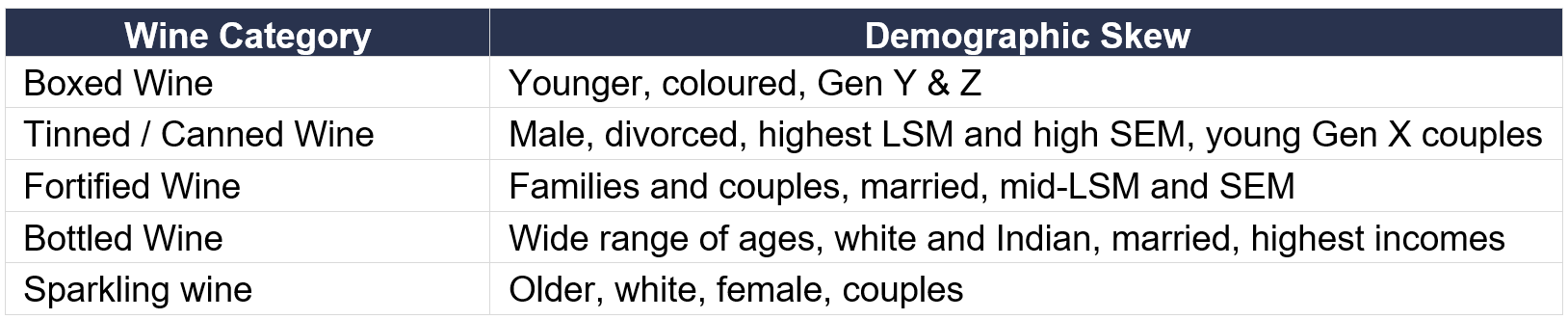

Many would find it impossible to imagine a South African celebration without wine. We are the seventh largest wine producer globally with the industry adding R56.5 billion to national GDP and employing a quarter of a million people. There are five wine categories that can be analysed in the MAPS data: boxed, tinned, bottled, fortified and sparkling. Once again, we look at how certain wine categories are over indexed to a set of demographics:

The wealthier demographic skew on tinned wines may come as a surprise. The category is growing increasingly popular, with half as many consumers as sparkling wine. With the demographics skewing to Gen X couples in higher LSM/SEMs. It is easy to see why a company like Woolworths has chosen to launch an exclusive tinned wine range with some celebrated South African wine estates.

“Understanding the diverse preferences of South African alcohol consumers, whether it’s through the lens of occasion, demographics, or changing trends offers a valuable opportunity for retailers to fine-tune their strategies. By leveraging data-driven insights, brands can align their offerings with consumer demand, enhance relevance and ultimately drive growth during this peak season and beyond,” concludes Eighty20.