Too much month left at the end of the money

Read the BusinessTech article here: South Africans earning over R15,000 a month are in serious trouble

Analysis of instalment-to-income ratios across three market segments

In recent reports, the financial strain on South Africans has been widely documented. Eighty20, South Africa’s leading consumer insights and data science firm, highlights the significant impact of formal debt instalments on South African consumers. The firm’s analysis specifically examines instalment-to-income ratios, providing a view into the financial burden faced by many in the country.

Financial institutions must ensure new loans comply with the National Credit Act (NCA), which requires credit providers to assess a borrower’s ability to repay. This involves an affordability calculation, evaluating the individual’s income, expenses, and existing debt to ensure loan repayments can be met without causing undue financial stress.

It includes various inputs to provide a clearer picture of an individual’s financial affordability, such as:

- Gross monthly income

- Net monthly income (after taxes, pension, medical aid and other statutory deductions)

- Living expenses (these can be standard calculations by the financial institution or expenses declared by the borrower such as groceries, school fees, rent, rates, insurance, etc.)

- Existing debt obligations (this is usually only formal debt, i.e., car, home, credit card and unsecured loans)

- The new loan repayment amount (principal, interest rate, term and monthly instalments)

- Some form of debt to income (DTI) ratio

This process assesses whether a borrower’s disposable income is sufficient to meet their total monthly obligations.

|

Standard Bank advises that if your ratio is higher than 43%, you should consider strategies to reduce debt. Benay Sager from DebtBusters is more circumspect, “In our experience, if debt repayment to net income ratio is over 30% the consumer is in the danger zone; if over 40% then their financial situation is not sustainable, regardless of the type of debt they are repaying, as indicated by the DebtBusters Money Stress Tracker. It is critical that consumers understand this ratio; and if its above 30%, to look for options to reduce it.”

While Debtbusters uses a net income monthly income measure, the most common way a DTI ratio is calculated is by dividing a person’s total monthly debt payments by their gross monthly income, or in other words, income before taxes or other deductions.

This metric is sometimes confused with another debt-to-income ratio, which compares total outstanding debt to total annual income. This ratio often exceeds 100%, as most mortgages are significantly higher than a person’s annual income.

|

To clarify, Eighty20 uses a slightly different measure which we call “instalment-to-net income ratio”, basing calculations on net monthly income, or income after tax. We do this because tax is a known deduction and is unavoidable, while other expenses differ and depend on the individual’s personal circumstances.

In South Africa, the debt-to-income ratio has been notably high. Eighty20’s estimates suggest that depending on whether median or mean figures are considered, this ratio can climb to 54% on average across the population. Specifically, the Middle Class and Heavy Hitters segments exhibit even higher mean ratios of 56% and 63%, respectively. These figures appear significantly elevated compared to other benchmarks.

This could either reflect potential data or modelling inaccuracies discussed later in this article, or indicate a broader issue with high debt burdens among South Africans. Using a median calculation makes the situation look slightly more manageable. In a significantly unequal country like South Africa, we believe the median is more insightful because a small percentage of the population earns significantly more than the majority. This can be seen in the graphic below:

Using the median for this ratio offers a more accurate depiction of the ‘typical’ scenario, as it is less affected by extreme outliers or unusually high or low instalments and incomes.

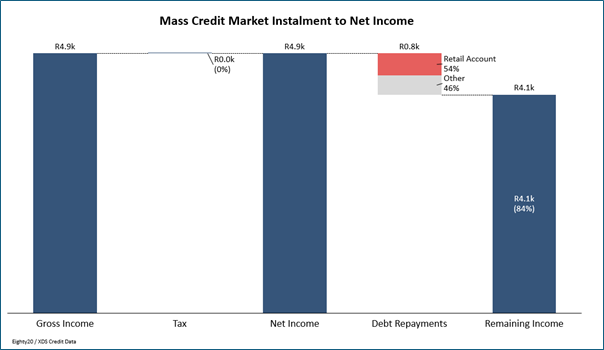

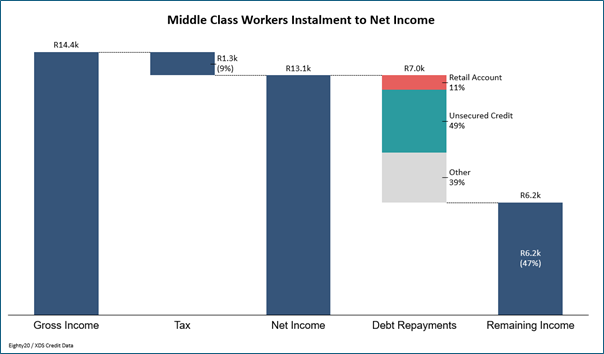

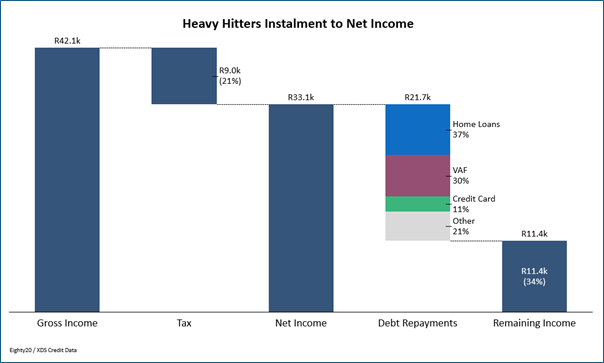

Eighty20 provides illustrations of a typical income and debt burden for three segments: The Mass Credit Market, Middle Class Workers and Heavy Hitters. These examples aim to present a ‘typical’ instalment-to-income ratio by analysing the subset of people (excluding outliers) within each segment who have the most common credit product combinations. As such, their ratios will differ from the above chart which measures everyone in the three segments.

The Mass Credit Market

The Mass Credit Market segment, primarily employed individuals earning less than R10,000 per month, consists mostly of women working as entry level nurses, teachers and administrative staff. About 80% of this group hold retail store accounts, while 17% have credit cards. Their household income is twice their personal income, with nearly a quarter receiving grants and almost half being single parents. In our example, an individual in this segment, earning a gross monthly income of R4,900 per month, falling below the tax threshold, has debt instalments totalling R782 per month—mostly retail store card debt. The median instalment-to-income ratio for this segment is approximately 16%, whereas the mean ratio is around 30%.

The Middle-Class Workers

This segment is predominantly married couples striving for a middle-class lifestyle, often juggling car and home loans along with children’s education costs. Many are dual-income households with substantial debt repayments. This group holds approximately 30% of all home and vehicle asset finance (VAF) loans in South Africa, though they account for only 20% of the total loan value. On average, Middle-Class Workers allocate about 56% of their net income (income after tax) to debt repayments. However, in a typical scenario illustrated below, the median instalment-to-income ratio is closer to 53%.

The Heavy Hitters

The wealthiest South Africans, known as the Heavy Hitters, are the predominantly male segment with the most assets. This group consists largely of families, and despite being less than 10% of the population, holds two-thirds of vehicle asset finance (VAF) loans and three-quarters of home loans by value. The segment is diverse in income, with some members just above middle-class earnings, while others receive multi-million-rand salaries. For this analysis, a monthly salary of R42,100 was used. In this example of a typical Heavy Hitter, debt repayments by median calculation account for 66% of net income, with two-thirds of their debt secured.

From our analysis, it’s evident that credit-active South Africans allocate a substantial post-tax income towards credit instalments, exceeding what regulatory and industry standards deem healthy. While there may be some data or modelling inaccuracies inflating these figures to some degree, it’s unlikely they would reduce to healthy levels. Key data considerations include:

- The incomes used by credit bureaus are a modelled estimate primarily based on an individual’s existing credit. Therefore, income estimates are typically most accurate for middle income, credit active individuals. Estimates for very low- and higher-income individuals have a lower confidence. For example, lower income customers may pool their income and have one member of the household take out credit on their behalf, while more wealthy customers might reduce their credit exposure over time and build alternative, passive forms of household income.

- The analysis reflects the mean or median income and instalments for a selected group within each segment, meaning that individual incomes and instalments may vary significantly from those shown.

- There are often two (or more) income earners in each household. Roughly 26% of credit active individuals are married, compared to 23% of the population. So, one individual in the relationship could be holding a disproportionate share of the debt burden.

High instalment-to-income ratios in South Africa stem from several factors:

- Higher borrowing costs: Since mid-2021, there have been 10 consecutive interest rate hikes, raising the Prime Lending Rate from 7% to 11.75% in 18 months. This has had a huge impact on mostly young, first-time home buyers who overstretched themselves in 2020/21 when interest rates were nearly 500 basis points lower than today.

- High cost of living: CPI consistently exceeded the upper limit of the Reserve Bank’s inflation target throughout 2022 and 2023, with average annual food inflation reaching approximately 7.93% from 2020-2023.

- Stagnant, generally low salary growth: DebtBusters suggests purchasing power diminished by 47% since 2016 when factoring in the impact of compounded inflation. If one factors in the big five expenses (food, petrol, electricity, medical aid, school fees) as the real indicator of inflation for middle income earners, then the situation is even more severe than what CPI indicates over the last several years.

“We have illustrated several metrics that can be used to describe a similar measure, and the industry would benefit from using a consistent methodology. Irrespective of the approach, however, it would seem that credit active South Africans are paying significantly more towards debt repayments than one might expect.” concludes Eighty20.