Understanding short-term insurance habits

Read the Bizcommunity article here: Navigating short-term insurance: Insights into SA’s consumer behaviour

How South Africans prioritise short-term insurance

South Africa, is a country grappling with high crime rates, economic volatility and climate change. With disposable incomes under pressure, these concerns underscore the crucial role of insurance as a safety net for individuals dealing with extreme and unforeseen events. Eighty20, South Africa’s leading consumer insights and data science firm, analyses the South African short-term insurance (STI) sector. The analysis delves into the demographics of STI holders, the economic and environmental challenges impacting consumers, and the significance of understanding consumer behaviour within the sector.

Short-term insurance provides coverage through policies that are typically renewed on an annual basis. This type of insurance is designed to protect against specific risks and losses, including vehicle, household and home contents insurance. It also extends to high-value items such as bicycles, smartphones, boats and airplanes.

South African short-term insurance consumer profile

Short-term insurance primarily covers assets, and in South Africa, where wealth is predominantly concentrated among a small, older demographic, insurance penetration is notably uneven. According to the Eighty20 National Segmentation, the affluent “Heavy Hitters”—comprising of just 4% of the population, control 75% of all mortgage values and 70% of vehicle asset finance. This group also accounts for nearly 30% of all short-term insurance holders.

|

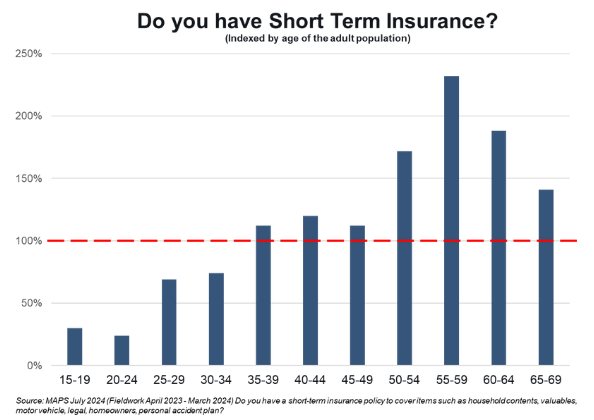

Nearly three-quarters of all short-term insurance is concentrated among four Eighty20 segments: Mass Credit Market, Middle Class Workers, Heavy Hitters and Comfortable Retirees. This concentration highlights a significant imbalance in insurance penetration, as illustrated by the accompanying graphs. Notably, individuals in LSM/SEM 8+ and those aged 35 and older are disproportionately represented among insurance holders.

Issues impacting Consumers and STI

The BrandMapp survey, a survey of households that earn more than R10,000 per month, asks what concerns keep people awake at night, with 3 of the top 10 impacting STI directly, particularly in terms of claims. The number one concern for South Africans is crime, with Eskom / grid failure ranked sixth, and climate change ranked ninth.

Housebreaking is the number one crime in SA, with StatsSA estimating 1.6 million incidences of housebreaking in 2023, representing 5.7% of all households in the country, increasing in the 2023 period by 10%.

The rise in housebreaking, which was exacerbated by power cuts, is not the only impact of load shedding on short-term insurance. The KPMG South African Insurance Industry Survey 2023 reported that load shedding also led to significant claims related to appliance damage from power surges and income loss or damage due to malfunctioning cold storage and other equipment during blackouts. Some insurers have experienced nearly a doubling of load shedding-related claims. Additionally, the failure of streetlights and traffic signals, due to load-shedding or poor service delivery, contributed to an increase in motor vehicle accidents.

|

The South African Insurance Association (SAIA), together with several insurance companies across the Western Cape, also reported experiencing significant claims following the level 4 to 8 storms during July in the Western Cape. The Western Cape government estimated the damage caused by the storms, which severely impacted 150 000 people and 47 000 households, would be more than R1 billion.

The Kwa-Zulu Natal Flood in April 2022 was the most catastrophic South African natural disaster yet in terms of lives lost, extent of property damaged, and economic consequences – Santam reported R4.4 billion in gross claims, resulting in the largest natural catastrophe loss ever recorded by the company.

Both are examples of how more frequent and more severe weather events are going to lead to higher claims for property damage. Insurers respond by adjusting risk models and premiums, resulting in less affordable insurance.

Economic landscape

South African consumers have faced numerous challenges in recent years, including a cost-of-living crisis, load shedding, job losses, and debt accumulation. According to the FinScope survey, the primary reasons for not having insurance are unemployment and insufficient earnings.

Despite these widespread economic difficulties, the short-term insurance (STI) industry has shown resilience. Unlike other sectors, where consumers have reduced spending on subscription services, downgraded medical aid, and shifted from luxury to generic brands, the STI sector has reported growth. In 2022, gross written premiums (GWP) reached R140.1 billion, marking a 9.7% increase from the R127.8 billion recorded in 2021. TransUnion reported further growth of 2.2% average premium change 2023 Q4 to 2023 Q3.

One hypothesis for why this might be the case is with disposable incomes under pressure, and a lack of savings amongst most South Africans, people realise they are unlikely to be able to recover from unexpected events, and therefore prioritise insurance more than ever.

Understanding consumer behaviour

In order to grow in this environment, insurers will need to invest in data analytics and customer relationship management systems to better tailor their products. Eighty20 looks at consumer’s insurance requirements through detailed profiling and then identifies the greatest areas of under-insurance and affordability This then enables us to identify the customer segments where growth lies, and develop marketing, sales and product strategies to capture these markets.

|

MAPS, is a nationally representative survey of 20 000 people produced by the MRF which asks numerous questions about short-term insurance data. It finds that price is not the primary driver at the point of purchase; interestingly product attributes are far more critical. However, price becomes crucial at the point of policy renewal or when considering switching providers. The most important consideration is how well the insurance will cover their needs, followed by price, then the reputation of the company.

In terms of advice people seek before they buy insurance, recommendations from family or friends are most important, followed by colleagues and lastly, social media.

The MAPS data further reveals how South Africans choose their short-term insurance provider:

- Do their own research online

- Calling companies for quotes

- Contacting a broker

- Asking for advice from family members

- Contacting your bank

The Mass Credit Market are most likely to call companies for quotes and contact their bank, while the Middle Class are most likely to contact a broker, and Heavy Hitters tend to ask family for advice.

“The need for insurance need is significant in SA, with crime, climate change and load shedding causing increases in claims.” says Andrew Fulton, Director at Eighty20. “The data shows that customers, despite tough economic times, continue to prioritise insurance. Part of this might be because insurers are making it even easier to take out insurance with ‘user based’ pricing options and rewards programmes, with a plethora of new digital entrants forcing innovation.